The rules no longer apply. The biggest challenge facing the new EU27 (the EU without the UK) is the growing threat to the international economic order. From banking to free movement of people and goods to international law and trade, bilateral alliances and unilateral moves have undermined many of the structures and bodies put in place to promote global co-operaton after WWII.

To succeed within this challenging new world order, the new EU will have to deal with many grave problems, both the upcoming ones and those already full-blown. Some of these are ongoing; the repercussions of the banking and government debt crisis, slow economic growth, the refugee and migration crisis, an increasingly aggressive Russia, and a democratic deficit. So, what are the trade and investment prospects for the new EU27?

As Brexit heats up, a new 2-part series from trade expert Eoin Gahan will explore these issues and more.

First, let's examine the figures. How does the EU fare in terms of trade and investment vis-a-vis its international competitors?

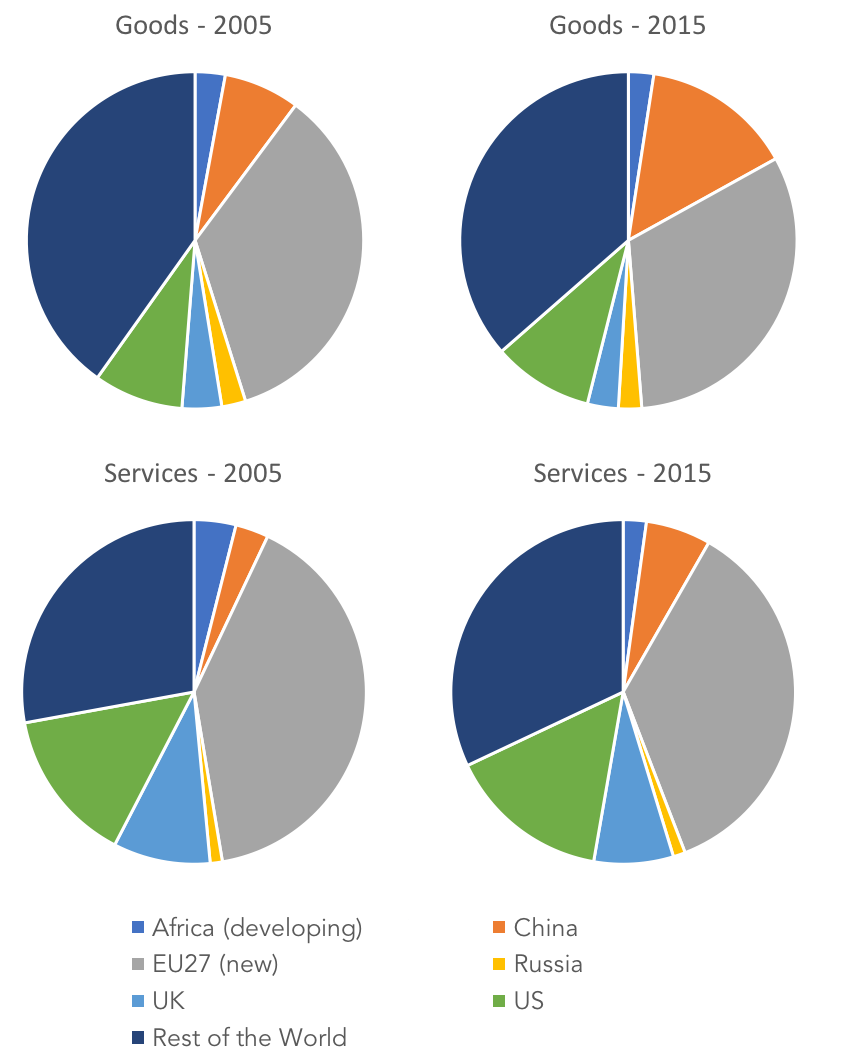

It turns out that the new EU27 has seen its share of world trade decline in recent years, both in goods and in services. It had 37.4 per cent of world merchandise trade in 1990 but this fell to 30 per cent in 2015. In services trade, its share fell from 38.9 per cent to 34.6 per cent between 2005 and 2015.

The reduction in shares is of course partly due to the rise of China and other Asian countries on world markets. But it is still significant that the EU27 saw sharp falls in the shares of world goods and services markets while the United States saw increases. This points to a lack of competitiveness. The transfer of manufacturing capacity to Asia, and services to India, indicate a lack of ability in Europe to achieve good returns from its own technological and innovation capabilities.

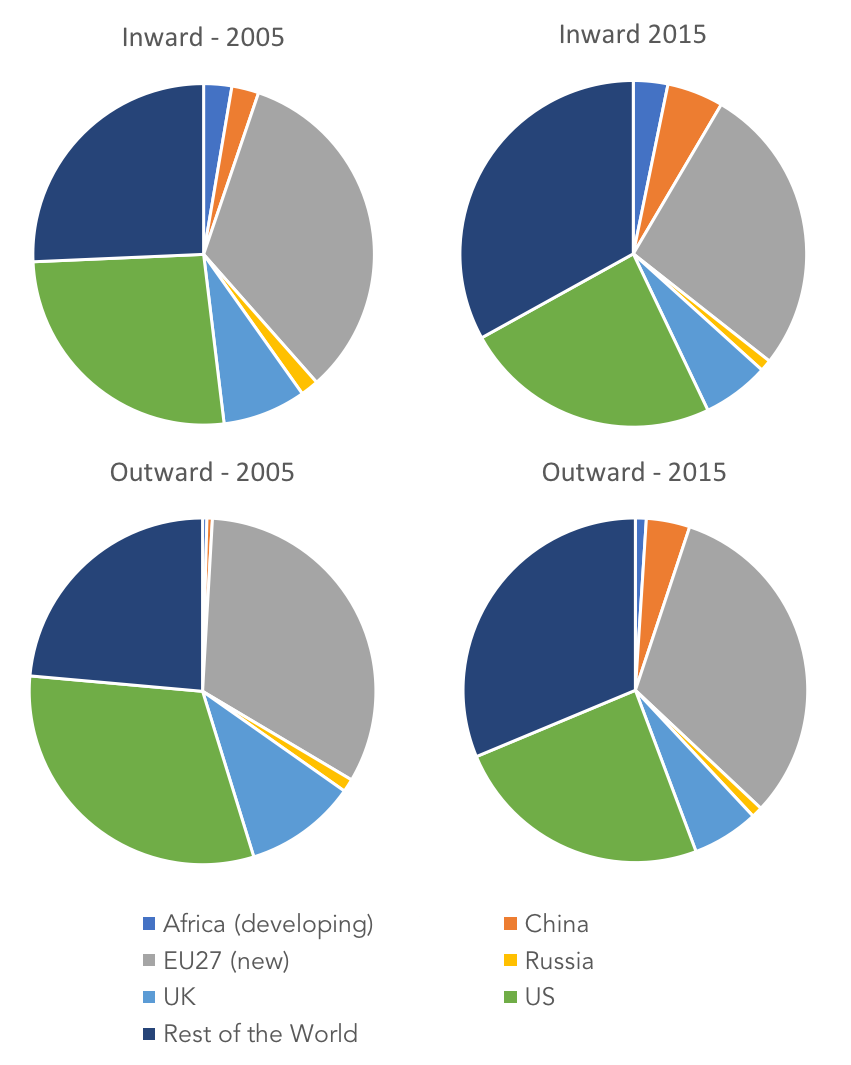

The position is similar with respect to foreign direct investment stocks. The EU27 has seen its share of the world’s inward FDI fall from 31.2 per cent to 25.3 per cent, although the decline in its share of the world’s outward FDI has been much smaller. For the EU27, the inward and outward FDI have very different significance. Inward FDI has contributed to restructuring, consolidation and improved efficiencies in some industries, but in others it has been in connection with access to skills, technologies, real estate and brands. Its outward FDI has traditionally been more concerned with access to natural resources and to consumer markets.

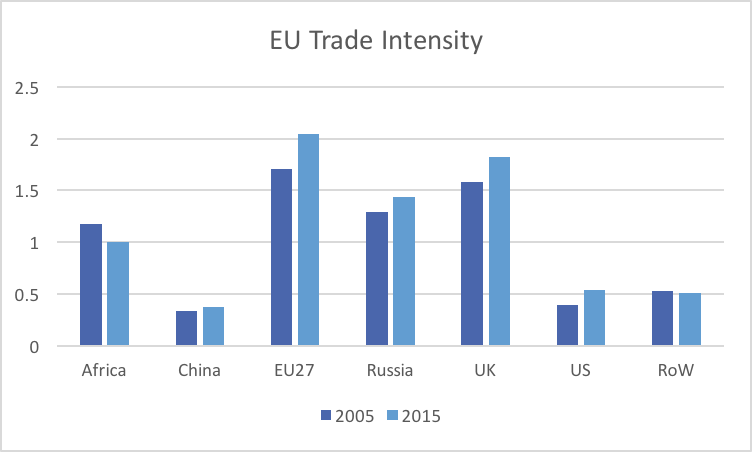

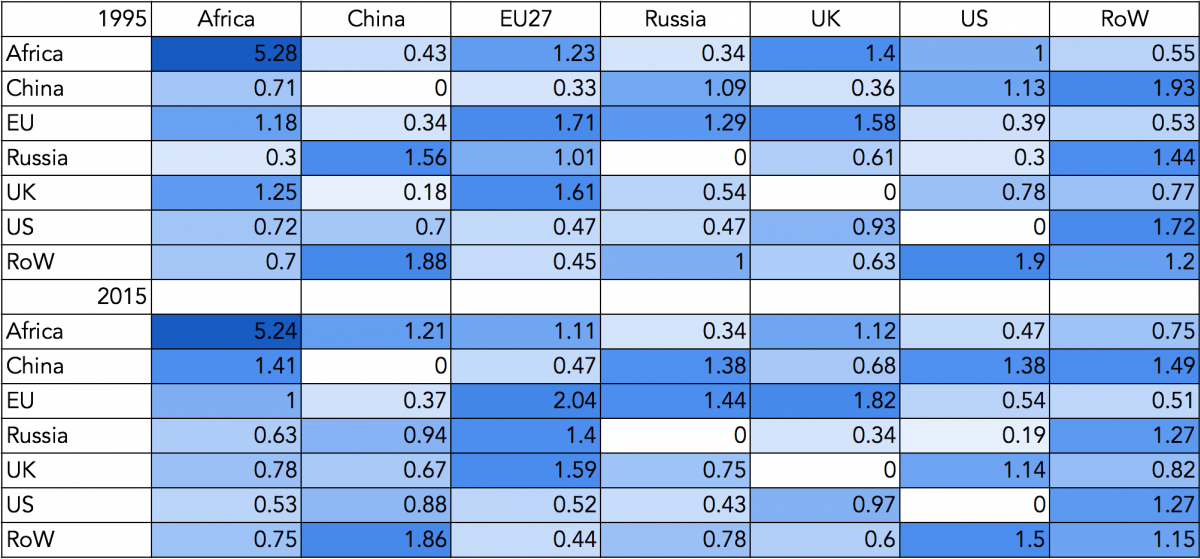

These are aggregate figures. It’s important also to consider the ways in which the EU and its trading partners relate to one another. Trade intensity indices from exports data give some indications. Such indices show how strong one group's exports to another group are, compared with the world’s focus on that market. A value of one shows that the focus is proportionate. Above one, there’s high intensity. Below one, there’s an implication that the market in question is being neglected in some sense. The values for the new EU and comparator countries and regions are given in the table below, for both 1995 and 2015 to look for longer-term trends.

Looking first at the new EU, the traditional relationship with Africa has been declining to an average intensity (interestingly there has been an even sharper decline in the UK’s intensity of trade with Africa). The US relationship with Africa was below one in 1995 and has declined even further. The new EU’s trade intensity with China, in spite of all the growth in that country, has hardly increased over the twenty years and is still well below average. The new EU has however slightly increased its intense relationship with Russia. With the US, the relationship is below one, but has increased in the last twenty years. Finally, the low focus on the rest of the world (principally Latin America and also Asia apart from China) has remained.

Looking at the other trade partners, China’s relationship with the EU has increased but is still weak. Its relationship with Russia is a high intensity one. Also striking are the figures in the row for the US: It has low intensity export performance to the new EU (much less than its relationship with the UK), and a relationship with Africa that was less than 1 (0.72, actually) in 1995 and which has fallen to 0.53 in 2015.

Brexit

For the new EU27, Brexit has its positives and its negatives. The latter are probably greater. The UK’s departure will mean that the new EU will have a significantly reduced share of world GDP and of world trade. Trade with the UK may suffer also, which will reduce growth and employment in the EU. The EU will also have reduced central funds as a result of the exit of a net contributor and the difficulty in getting the remaining members to make up the difference. In addition, the EU has lost face, no matter who is ultimately to blame for the separation. Its clout in world fora, and the degree to which its voice is heard, and whether that voice is a confident one, are put in question. Media speculation, especially in the UK, around which country may be next to leave doesn’t help either.

However, there are also likely positive aspects of Brexit in FDI terms. Much of the outside investment in the UK, to the extent that it is focused on access to the Single Market, will be considering its options for the future. For financial services, Luxembourg, Paris, Frankfurt and Dublin are all in contention. But other industries, such as airlines and pharmaceuticals are also casting around for solutions. These investment relocations may counter some of the negative economic growth impact for the EU27 brought about by Brexit.

The task of the new EU27 is to minimise the negative consequences of Brexit while capitalising on the opportunities created. But this will be complicated by the UK’s exercise of its much-desired freedom to negotiate its own trade deals. The agriculture and food sectors will be particularly affected. If the UK makes a deal with the US, it is likely to be considerably more favourable to the US than the Transatlantic Trade and Investment Pact (TTIP) would have been, partly because the UK is in general sympathetic to the US regulatory approach and also because it will be the weaker partner in the negotiation. The UK will be keen to show that it no longer needs the EU to make its trade deals, but it will be without the analytical and negotiating resources available to the US. Thus GM crops, hormones in beef and antibiotics in chicken will probably cross the Atlantic, since the UK is a net importer of food. This will further complicate any new trade relationship between the UK and the EU.

A New World Order

The biggest challenge facing the new EU27 is, however, one faced by the world as a whole: the threat to the international economic order. This order had two characteristics: it was avowedly universal in character, and it was intended to be a rules-based system. Trade and investment benefited from this.

From the end of the Second World War, the international trade regime was intended to be universal in coverage, even if the GATT and the World Trade Organisation, its successor, had restricted membership. Even now, not all countries are members of WTO, and the WTO process is stalled in any case. Instead we see a proliferation of regional trade agreements (RTAs) involving various combinations of countries and with no standard coverage. The EU has in recent years pursued its own trade agreements as a result of the stalled WTO process.

The old rules no longer apply. Military conflicts are increasingly automated, with little regard to the principles of international law. Economic sanctions are imposed on countries, assets are frozen and individuals are refused travel, without any agreed process or right of appeal. To the extent that these measures have replaced actual warfare they are to be welcomed, but they undermine the concepts of justice systems at the international level and can in fact encourage warfare later on. Within the EU, this undermining of the rules-based system can be seen in the weakening of economic criteria in government finances, as well as in the weakening of the Schengen agreement and the rejection of the EU system by the current governments in Poland and Hungary.

Finally, the US President is currently an additional key contributor to global political and economic uncertainty. His kindest supporters will say that this is part of a grand strategy, but nothing he has said or done provides confidence that he understands what he is talking about, or means what he says. This makes the EU’s efforts to navigate an uncertain world that much more difficult. The abandonment of the Transatlantic Trade and Investment Pact (TTIP) is not a catastrophe: it was a US initiative that was regarded with great suspicion by many Europeans, and trade and investment between Europe and the United States will continue to grow in any case. However, the Trump administration has cut back on development assistance and is still repudiating the Paris Agreement on climate change. These steps strike at core issues for the EU, issues that Europeans care about and take seriously. The EU and other groupings will have to make considerable efforts to meet the global shortfalls and maintain momentum.

The existing order is under threat. The consequences for economic growth are serious, and the policy response has to be bold and vigorous. Some voices call for a return to the WTO, reform of the United Nations Security Council, more resources for the International Criminal Court, and so on. All of these changes would be welcome but much more is needed.

Traditional diplomacy will help. However, there is a need for a new approach, one that engages the business sector far more deeply and comprehensively. On both sides of the Atlantic there are people, funds and technologies which, if jointly engaged, could benefit not only those directly concerned but the world economy as a whole. There is no need for another summit where PowerPoint substitutes for thought. But there is a need for something different; new ideas, trade and investment projects on a scale and of a scope that can capture the imagination and point to promising paths of business growth.